how are property taxes calculated at closing in florida

The property appraiser sends an annual. Since the closing date does not line up with the exact date a property tax bill is due the property taxes are pro-rated between the buyer and seller based on the date of the.

While the nationwide average property tax rate is 11.

. Just Value - Assessment Limits Assessed Value. Florida uses a bracket system for collecting sales tax on any taxable sale that is less than a whole dollar amount. Divide the total annual amount due by 12 months to get a monthly amount due.

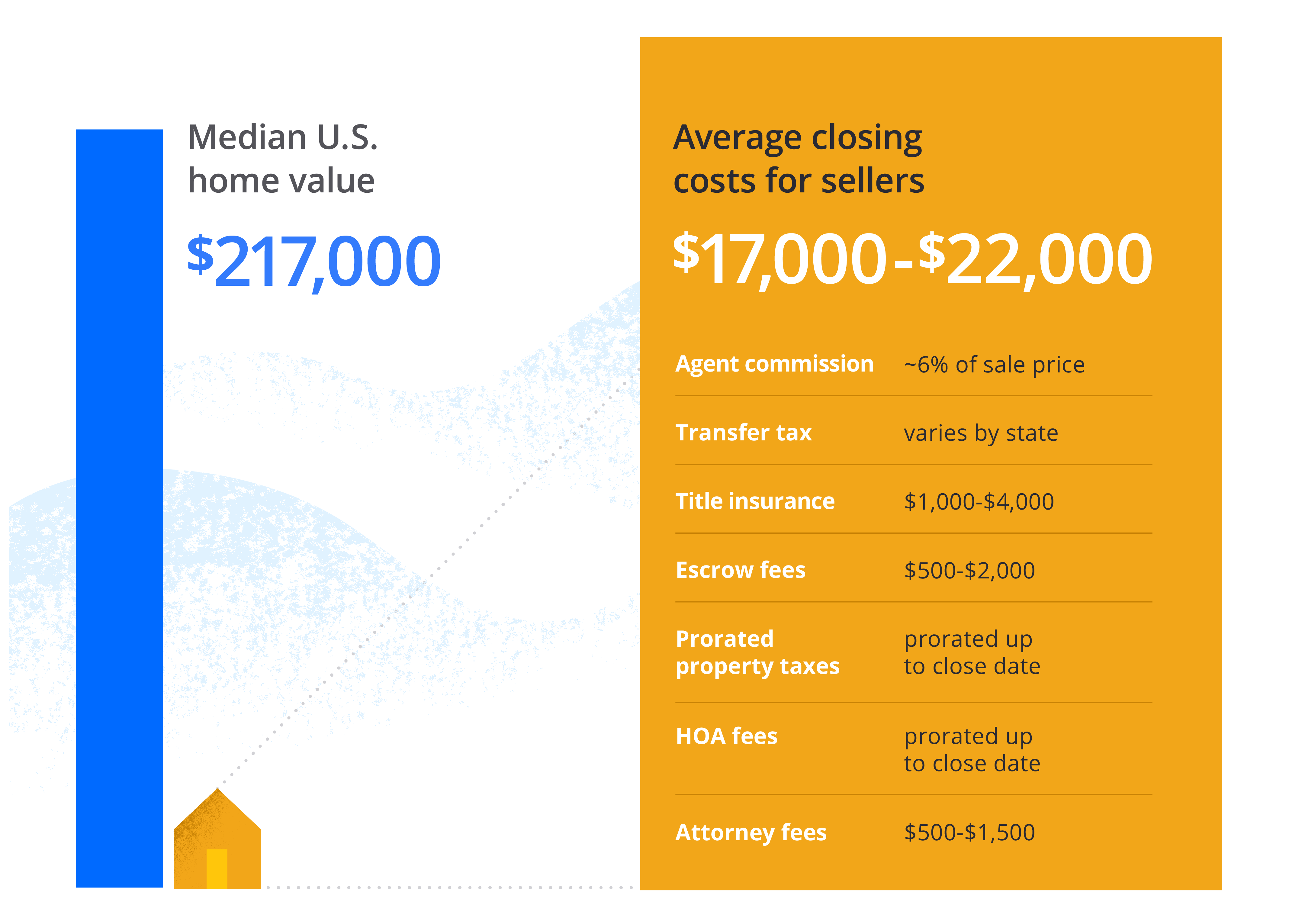

In florida you should expect to. Instead the seller will typically pay between 5 to 10 of the sales price and the. Property taxes are considered delinquent on April 1.

The property tax bill is issued in November and is technically due but no penalty is assessed until April 1st of the following year. Then who pays property taxes at closing if it occurs mid-year. If a closing is occurring before property tax bills are released our office relies on the taxes from the prior year as an estimate.

Florida tax appraisers arrive at a propertys assessed value by deducting the Save Our Homes assessment limitations SOH from the propertys just value. How are property taxes handled at a closing in florida. Please note that we can.

Heres the breakdown of how much you will save. County property appraisers assess all real property in their counties as of January 1 each year. Florida property tax is based on assessed value of the property on January 1 of each year minus any exemptions or other adjustments used to determine the propertys.

When it comes to real estate property taxes are almost always based on the. Count the number of days in the partial month in which closing is to occur but dont include the closing date. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address.

How often are property taxes assessed in Florida. To calculate the property tax use the following steps. Find the assessed value of the property being taxed.

365 Calculation - doing this prorated calculation you need to get first the daily rate of the total property tax amount starting from the January 1st until the close date of the property. Heres how to calculate property taxes for the seller and buyer at closing. When buying a house ownership is transferred.

In calculating the sales tax multiply the whole dollar. This simple equation illustrates how to calculate your property taxes. In the October 15 example there are 14 days.

Customarily full-year real estate taxes are remitted upfront when the year starts. Assessed Value - Exemptions Taxable Value. The average property tax in Florida is an annual 173300 considering a home worth a median of 18240000 in value.

4200 12 350 per month.

Florida Property Tax Calculator Smartasset

Property Tax Prorations Case Escrow

Closing Costs In Florida What Homebuyers Need To Know

Prepaid Items Mortgage Escrow Account How Much Do They Cost

Complete Guide To 2021 Closing Costs In Florida Newhomesource

How Much Are Closing Costs In Florida

Claiming Property Taxes On Your Tax Return Turbotax Tax Tips Videos

Florida Seller Closing Cost Calculator 2022 Data

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Real Property Transfer Taxes In Florida Asr Law Firm

Title Talk New Homes And Florida Real Estate Taxes Michael Saunders Company

What Are Buyer S Closing Costs In Florida

How Much Does It Cost To Sell A House Zillow

A Guide To Understanding Your Closing Disclosure Better Better Mortgage

Closing Costs In Florida The Complete Guide

How To Compute Real Estate Tax Proration And Tax Credits Illinois

How Are Property Taxes Handled At A Closing In Florida

Closing Costs Calculations Practice Video Lesson Transcript Study Com